Both brands and suppliers have come to a significant realisation: the sales and volumes of brands can be traced from the manufacturer to formal retailers or wholesalers. However, while access to sales-out data may come at a price, the ultimate destination of the product remains a mystery. This often leads to common questions, such as:

• Who is the target audience purchasing my product?

• How is my product being presented on store shelves?

• How does my product’s performance compare to that of my competitors?

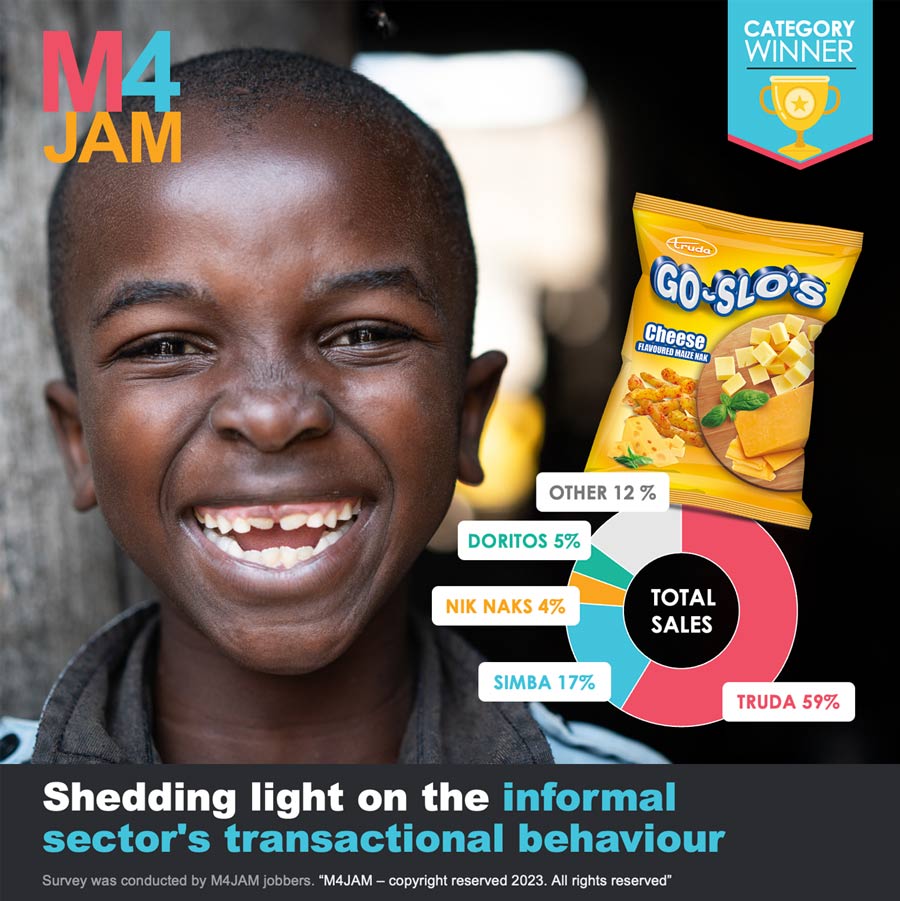

These critical questions serve as the foundation for developing an effective strategy. M4Jam has leveraged our cutting-edge technology and crowd-on-demand to amass transactional data from real orders across various informal retailers. Today, we are delighted to share category performance data that unveils the brands making waves, as well as those that have fallen from grace.

Over the next few weeks, we will delve into specific FMCG sectors in two key markets: KZN and GP, which we have diligently monitored and tracked.

In today’s analysis, we focus on the Chip category, where we have collected over R5 million worth of data in recent months. This category is fiercely competitive. Truda Go-Slo’s has emerged as the standout performer, capturing nearly 18% of the market share across both regions. The Truda Foods brand dominates the market, commanding just under 55% market share.

Notably, we observe regional preferences manifesting differently in each market. Gauteng shows a strong preference for Nik Naks, with a 14% market share, while Kwazulu-Natal favours the Truda Chippa (18%) and Truda Bigga (12.6%) brands.

If you would like to request data for a specific category, please feel free to contact us.